Building wealth doesn’t happen overnight. It doesn’t matter if you’re brand-new parents at age 22 or if you’re in your final few years of a 30-year career and age 52, everyone can follow these 5 steps and create a considerable financial advantage and surplus in your future. The good thing about these 5 Keys to Building Wealth is that they are basic foundations that are proven no matter when you put them into play to yield results because they work!

1. Debt Is NOT your friend… Don’t hang out with it willingly!

It’s often necessary, especially earlier in adulthood, that you need to finance larger purchases such as your vehicle(s) or even your home. Often it’s unavoidable. However, the mentality of being “comfortably in debt” is a dangerous and slippery slope you need to not lean on forever.

The only truly good debt to have is NO debt! Cash is king and the sooner you realize that the better equipped you will be to immediately start saving for your future. Remember that for every financed payment you make on an automobile or a credit card, those are dollars that could have been invested in a retirement fund for you and your spouse.

Using a system to pay off all your debt early in life is the smartest thing that I ever did. A financial mentor of mine in my 20’s was Dave Ramsey. I read his book “The Total Money Makeover” and it changed my life forever. I put into play his debt snowball and, inside of 2 years I had paid off all my debt outside of my Mortgage (that’s another article). It is a very easy way to rank in order your debt and allocate any extra money to use towards additional payments until all are gone!

Whether it’s a proven system like what I described above or one that you come up with on your own, it’s so important to free yourself of the chains of debt as early in life as possible for building wealth for your future. It’s not smart to continue to believe debt is just a part of life. Coming from someone who has zero debt and no mortgage, and has been in this position for a decade, I’m here to tell you paying for a car or vacation completely in Cash is a wonderful feeling!

2. Crisis Happens in Life! Are you financially ready for one?

Emergencies in life can happen! Look at the financial implications of the Covid-19 Pandemic! So many out of work and so much hardship! It has pulled the curtain back on so many as to how much they lived paycheck to paycheck.

It’s a smart practice to have 3-6 months’ worth of wages put aside in case of an emergency like what we’ve experienced with Covid-19. Even a major bill from an automobile breaking down can severely drain your finances if you don’t have an emergency fund like this in place.

This is money that is not to be touched. Put a lock and key on it. It’s for your own good because when life happens, and it will, you’re going to want to be ready to jump over that hurdle without issue!

3. The Piggy Bank is not just for kids! Every penny counts when building wealth!

How many of you are putting away money from every one of your paychecks? If you’re not, you’re not alone by any means. However, you’re going to need to start if you want to have a fully funded retirement.

Many financial experts agree that if possible households should put 15% to 20% away every week. That means taking that direct deposit weekly or bi-weekly and separating that amount from the rest to save for the future. That’s going to require a lifestyle change if I’m being honest and upfront. It might mean eating out less or having a little more restraint when shopping online. You’ll thank yourself in the future when you have money to enjoy the golden years!

The next question will be where do I put that Money? Is simple savings account from my bank or credit union enough? Do I go more aggressively and build a stock portfolio and buy some stocks as a hobby? What about a 401(k) or Roth IRA? A lot of that depends on your comfort level with the preceding. It’s wise to consult a professional such as your financial advisor or even your bank.

Start with your next check! Being that Millionaire Next Door doesn’t happen overnight. It requires years and years of smart saving. Let’s get started now!

4. Create a Budget you can Live with!

Curbing unnecessary spending is often one of the best ways to save additional money, however, it also proves to be one of the most difficult things for many to do. Creating a Monthly budget that you can live with is very important to help you build for the future and grow your savings.

The first thing you do is limit or cut out things that you perhaps are doing too much. From eating out to grocery shopping to even cutting back on the movie theater, there are many ways to create a budget you can live with and still enjoy life.

Having a Budget will help you create those additional dollars for the other 4 areas of this article. The quicker you can enact all of these important points the quicker you start significantly saving for your future and building wealth!

5. That Pesky Mortgage…What do I do with that? Plan to pay it off early!

Did you know that those who are fully ready for their golden years had their house paid off well in advance and years before they entered retirement? Those individuals had done it inside of 10 to 20 years on average. For me, I had mine paid off in 8.5 years of a 30-year mortgage.

The best way to look at this, is to imagine what you could do in planning for the future if you didn’t have that large mortgage every month? Gives you goosebumps, doesn’t it? That’s where you have to get to as fast and as smart as possible.

But how? How do you do that? Well, there are a couple of obvious ways when you look at things simply. As soon as you eliminate your debts as we discussed in Step 1 above, you’re going to free up hundreds of dollars a month. That could for some be thousands of dollars. The argument you have to solve for yourself is why not use that extra money and make double mortgage payments a month and apply that snowball to your mortgage too? It’s something to seriously consider! I did!

Another way of building wealth is with a Side Hustle! That combined with the extra money I saved from having no debt is exactly how I accomplished mine in a little over 8 years. Find something your passionate about and create a new side business! This required me when I started my side hustles to put on the back burner all my Netflix habits. I used that extra time to create extra side income to fund my future!

What are you waiting for, let’s get started building wealth TODAY!

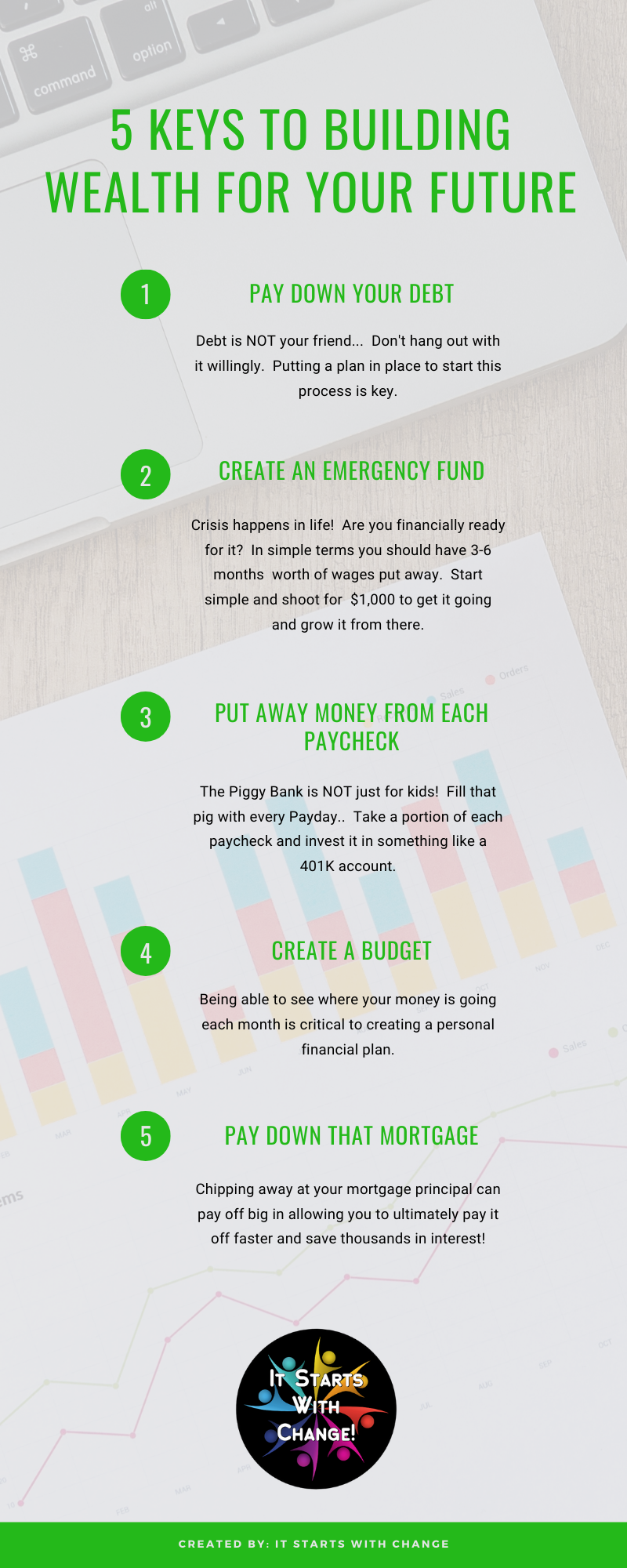

Please feel free to save or print our 5 Keys to Building Wealth for Your Future Infographic. Use it as a tool to refer back to whenever you need a reminder or a little push on your wealth-building journey!

6 Responses

Website is looking good boys!!

Absolutely LOVE this article Jeff. If people realized how GREAT FREEDOM feels, they would give up the things that give them short lived happiness. We have been debt free for a few years and retired Jan 2020. It has been amazing! We talked to our friends and families so much but most choose NOW over early future freedom. When we retired they were shocked, said things like, oh you were serious, man I wish I listened, etc… We work with people now in helping them achieve FI, Financial Independence. Have you heard of the FIRE movement? Financial Independence Retire Early, it's a great movement where young folks are adapting to because they see the positives about the freedom. THANKS for another great article.

Right on Jack! Have not heard of the Fire movement but for sure gonna look it up!! Hey thanks for the support and checking out our site and article!